STOP FORECLOSURE NOW!

OPTIONS AVAILABLE

- Forbearance

- Loan Modification

- Reinstate/Refinance

- Bankruptcy

- Equity or Short Sale

- Deed In Lieu

- Rent the Property

- Service Members Civil Relief Act (SCRA)

Forbearance

Forbearance is a term that refers to the temporary reduction or postponement of payments, such as for loans or mortgages. It happens when the lender grants the borrower momentary relief from paying off their debt due to hardships such as unemployment, injuries, illnesses, or natural disasters.

If you are a borrower and seek assistance in financial hardship, you can consider options where you can request forbearance. Although forbearance allows you to pay off your financial obligations at a later date, you will still need to repay any reduced or missed payments in the future. Specific terms of payment relief, such as interest payments and the length of the loan, must be negotiated between the lender and borrower.

How Does Forbearance Work?

Missed payments can be added to the end of the loan’s repayment schedule. For example, if you have a monthly loan repayment schedule and your lender allows you to miss ten loan payments during the forbearance period, it means your loan will be extended by an additional ten months.

Alternatively, you may also be given the option to amortize postponed payments over the remaining portion of the loan. After the forbearance period is over, it means that your monthly loan payment will be higher than before to make up for the missed payments. Your loan will still be completely paid off at the end.

On the other hand, some lenders may also provide the option for you to do a balloon payment or a lump-sum payment. If you have any missed payments, you can pay them all at once at the end of the forbearance period.

Do I Qualify for Forbearance?

Depending on who your lender is, there may be standards that you need to meet or situations that you need to demonstrate before qualifying for payment relief, such as:

- Financial hardship: Layoffs, reduced income, or failure of a business

- Medical hardship: Serious illness or long-term disability

- Disaster: Natural disasters or life-threatening accidents

Separation from a primary income earner: Divorce or death of a family member who is the primary income earner in the family. After determining your qualifications, you may also need to fill out an application. You are recommended to speak to your lender or service provider for additional details about the specific terms of the loan.

Different Types of Forbearance

- Mortgage

Several payment relief options for mortgages are available, depending on your service provider. They may allow you to defer payments for a certain period of time or reduce your mortgage payments by a certain amount. However, one must consider the impact of extending your mortgage’s terms and how they affect your interest payments.

- Student loans

Students who face difficulties in paying back their loans often apply for payment relief. Students who qualify for relief of payment should also consider the interest that will accrue on the loans.

- Credit card

Some credit card companies are able to grant payment relief to consumers who are facing hardship. Examples of relief for credit card payments include postponing due dates for monthly bills, lowering minimum payment amounts, decreasing interest rates, or canceling late payment fees. The specific type of relief you can get depends on your credit card issuer and the type of card you own.

Loan Modification

A home loan or mortgage modification is a relief plan for homeowners who are having difficulty affording their mortgage payments. Borrowers who qualify for loan modifications often have missed monthly mortgage payments or are at risk of missing a payment.

Here’s what you need to know to get a mortgage loan modification and stay in your home.

What Is a Mortgage Modification?

Modifying your mortgage can help you avoid foreclosure by—either temporarily or permanently—adjusting the length of your loan, switching from an adjustable-rate to a fixed-rate mortgage, lowering the interest rate or all of the above. Unlike mortgage refinancing, loan modifications don’t replace your existing mortgage with a new one. Instead, they change the original loan.

Borrowers with Fannie Mae- or Freddie Mac-owned mortgages might be eligible for a Flex Modification, which allows lenders to reduce the interest rate or extend the length of your loan (which shrinks the monthly payment amount but doesn’t change the amount owed).

For homeowners facing hardship due to the coronavirus pandemic, a loan modification can help you reduce your monthly payments so that they fit your current budget. Those who are already in mortgage forbearance can request a modification after the forbearance expires if they still need mortgage assistance.

Under the CARES Act, borrowers with federally-backed loans are entitled to up to one year of forbearance. Although most home loans are eligible for this type of forbearance, approximately 14.5 million home loans are not covered because they are privately owned.However, not all lenders offer loan modifications, even those home loans covered under forbearance provisions in the CARES Act. So be sure to contact your lender to come up with a doable plan (whether it’s a forbearance, modification or something else) that will prevent you from defaulting on your loan.

Who Qualifies for a Loan Modification?

Borrowers facing financial hardship—for any number of reasons—might qualify for a loan modification; however, eligibility requirements are different for each lender.

Some lenders require a minimum of one late or missed mortgage payment or imminent risk of missing a payment in order to qualify. Lenders also will want to assess what caused the hardship and whether a modification is a viable path to affordability.

In other words, if you lose your job and no longer have any income, a modification might not be enough to get you back on track. However, if you start earning less (due to a job change or other factors), you might still be able to make regular payments, but only if you can reduce the monthly cost.

There are several reasons why people might no longer be able to afford their current mortgage payments, which might qualify them for a modification. Lenders will likely ask for proof of hardship. These reasons include:

Loss of income (due to a drop in wages or death of a family member)

Divorce or separation

An increase in housing costs

Natural disaster

Health pandemic

Illness or disability

If you’re suffering from financial hardship, be sure to talk to your lender right away. Find out whether you qualify for a loan modification, per their rules, and if that solution makes sense for you.

How to Modify Your Home Loan

There are several ways your mortgage lender can modify your home loan, from reducing your interest rate to making your mortgage longer in order to lower your monthly payments.

Reduce the Interest Rate

Shaving your interest rate can reduce your monthly mortgage payments by hundreds of dollars. A $200,000 mortgage payment with an interest rate of 4% on a 30-year fixed-rate loan is about $955 per month, compared to the same loan with an interest rate of 3%, which comes out to $843 per month. This is similar to refinancing your loan, but the difference is that you don’t have to pay closing costs or fees.

Lengthen the Term

Extending the length of your loan is another strategy lenders use to make the monthly payments more affordable. For example, if you have a $100,000 mortgage at an interest rate of 4% with 15 years left, you would pay $740 per month. If you extend that loan by 10 years, you end up paying $528 per month. Keep in mind, you’ll pay more interest over the life of the loan if you extend it.

Switch from an Adjustable-Rate-Mortgage to a Fixed-Rate Mortgage

Switching from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage might not lower your existing payments, but it could help protect you from rising interest rates down the road.Since ARMs are set up to have floating rates, they change with the market. For example, if your interest rate is 3.5% and the average rate rises to 4%, so will your rate. This can be a bad scenario if you’re in a rising-rate environment. By locking in your interest rate, you’re guaranteed to pay the same interest rate over the life of your loan, regardless of what the market does.

Roll Late Fees Into the Principal

If you have accrued past-due charges on things like interest, late fees or escrow, some lenders will add that to your principal balance and reamortize the loan. That means the amount you owe will be spread out over time with the new balance. If you extend the length of your loan, you might end up paying less in monthly payments even though you owe more toward your principal.

Reduce the Principal Balance

In rare circumstances, lenders will actually lower the amount you owe, also known as a principal modification. These were more common during the housing crisis when loose lending standards prevailed and home values tanked, leaving many borrowers underwater with their mortgage.Whether a lender decides to reduce the principal likely depends on the current local housing market, how much you owe and what their loss would be if they went this route versus a foreclosure.

All or Some of the Above

Some borrowers might need a combination of actions in order to make the monthly mortgage bill manageable. Depending on your need, a lender might reduce the interest rate and extend your loan so that your monthly mortgage payment is reduced in two ways, without touching the principal balance.The lender likely will go through a cost-benefit analysis when assessing the type of modification that makes sense for both parties.

How Can I Apply for a Loan Modification?

Homeowners who are facing financial hardship that makes it impossible to fulfill the mortgage contract should get in touch with their lender or servicer immediately, as they might be eligible for a loan modification.Typically, lenders will ask you to complete a loss mitigation form. Because foreclosures are so costly for investors, a loss mitigation form helps them look at alternatives, such as loan modifications, to figure out what makes the most financial sense.

Be prepared to submit a hardship statement; mortgage and property information; recent bank statements and tax returns; profit and loss statements (for those who are self-employed) and a financial worksheet that demonstrates how much you’re earning versus spending.

If your loan modification application is denied, usually, you have the right to appeal it. Because rules vary by lender, find out when the appeal deadline is. Next, you’ll want to get precise information on why your loan was denied, as this will help you prepare a better case in your appeals.

There are many reasons why you might not qualify, from not providing sufficient proof of hardship to having a high debt-to-income ratio (DTI). A high DTI means that you have a lot of debt relative to your income, which might signal that you can’t afford your mortgage, even at a modified amount.Working with a housing counselor or attorney who specializes in mortgage modifications can improve your chances of getting approved for a loan modification.

Will Modifying My Mortgage Hurt My Credit?

If the modification is federally backed (i.e. owned by Freddie Mac, Fannie Mae, VA, FHA or USDA) and is a result of the coronavirus, then it will not be reported to the credit bureaus per the CARES Act.Otherwise, some loan modifications might be reported as settlements or judgments, which could result in a ding to your credit. Be sure to talk to your lender about if their policy is to report modifications. However, a loan modification is not as damaging as a foreclosure.

Reinstate/Refinance

Occasional financial struggles can cause us to fall behind on our home mortgage. When you fall behind on your mortgage payment, the amount that you owe is known as “arrears.” There are options for loan modifications that help you stay in your home and allow you to continue making your house payments without paying the total amount of arrears all at once.

However, sometimes people prefer to pay all of the arrears up front and continue paying on their current mortgage loan. This process is called a loan reinstatement. To get a loan reinstatement, you need to pay the total amount of the mortgage arrears and all of the associated fees to bring your loan status to current. Lenders prefer loan reinstatement because the foreclosure process can be long and complicated. Also, depending on the housing market, they may have to take less money than the property is worth.

The Loan Reinstatement Process

The first step in reinstating your loan is to determine if your lender has started the foreclosure process. Once you stop paying your mortgage, your loan goes into default. When that happens, you’ll receive a letter from your bank. Once default begins the bank files paperwork with the court that institutes the foreclosure process.

If your house isn’t in foreclosure, you can ask your lender for a reinstatement quote. These documents are good for 30 days before your payment date meaning, for example, on June 1 you can request a reinstatement valid

through July 1.Once you pay the amount of money due on the reinstatement quote, the default is taken care of, and you can resume paying your mortgage as usual. Just make sure that you pay the exact amount listed on the quote. The lender usually cannot proceed with the foreclosure process once you pay all of the fees and back mortgage payments. However, in order to assure that the foreclosure process has been dismissed, you should have legal representation. The foreclosure process usually takes a while depending on where you live, so you have time to work with your bank to reach some type of solution.

Additional Things to Know About Reinstatement

Don’t accept verbal reinstatement quotes. You need to get it in writing because a verbal quote may be incorrect or change. With the reinstatement quote in writing, you have documentation if you need it for proof later. If for some reason you think that the quote is incorrect you can send a “notice of error” to your lender that includes a description of the error and your name and identifying information. If there is an error, the lender must correct it within seven business days.

Reinstatement After Foreclosure

Typically, mortgage reinstatement is the last effort to prevent foreclosure on your property. Once the bank initiates the foreclosure process, instead of talking to your bank, you should hire a foreclosure defense attorney who will represent you, file the appropriate papers with the Court and contact the attorney for the lender. At this juncture, there are time considerations and you should waste no time in retaining legal counsel.

Refinance

Depending how late you are on loan payments and your financial situation (job stability, income and credit score), this may not be a viable option in many cases.

Bankruptcy

Can Bankruptcy Stop Foreclosure?

Yes, filing bankruptcy can stop a foreclosure. At the very least it’ll buy you some time. Whether filing a bankruptcy case can help you prevent a foreclosure for good depends on how far behind you are on your mortgage payments and what type of bankruptcy you’re filing. But, let’s start with a few foreclosure basics, first.

Foreclosure Basics

The foreclosure process often depends on the type of mortgage loan you have. But, no matter what the specific state law says, generally speaking, a foreclosure happens when a homeowner falls behind on their mortgage payments. If they can’t catch up quickly enough, their mortgage lender forecloses on the mortgage or other real estate loan. As part of the foreclosure process, the lender either takes the house or sells it to a third party.

Each state has laws that govern foreclosure proceedings. In some states, all foreclosures involve a lawsuit against the homeowner. That’s called a judicial foreclosure. Other states have alternative – nonjudicial – foreclosure options.

Right Of Redemption

Depending on your state’s law, you may be given a certain amount of time to redeem the property. A redemption typically requires the homeowner to make a lump sum payment paying off the outstanding mortgage balance and the foreclosure costs. The specifics depend on your state’s laws.

Deficiency Balance

If the bank can’t sell the property for more than the mortgage balance, they may try to collect the deficiency judgmentfrom the homeowner. For example, if the mortgage balance at the time of the foreclosure sale is $250,000 but the highest bidder only offers $200,000, the bank can turn around and sue the homeowner for the $50,000 difference. After getting a judgment, the lender can start a garnishment to collect the deficiency. Some, but not all states have anti-deficiency statutes to protect their residents against these deficiency judgments.

Some homeowners attempt to sell their property through a short sale to avoid issues with a deficiency balance. Of course, that only works if the mortgage lender forgives the balance still owing on the mortgage loan after the short sale has closed.

Home Equity

If you have home equity because the mortgage loan balance is less than the value of your home, you don’t have to worry about a deficiency balance. But, you’ll want to make sure that you’re able to protect the full amount of your home equity with an exemption. Otherwise, filing bankruptcy may not be the best course of action.

Bankruptcy and the Automatic Stay

The automatic stay is the part of the bankruptcy law that bans creditors from taking any kind of collection action once a bankruptcy case has been filed. That’s not just limited to wage garnishments and phone calls; stops a foreclosure proceeding dead in its tracks. Someone can file bankruptcy today to stop a foreclosure sale scheduled for tomorrow morning.

But, that’s not the entire story. Real estate loans are secured debts and the type of bankruptcy you file determines what you can do from there.

Stopping a Foreclosure with Chapter 7 Bankruptcy

Chapter 7 Bankruptcy is the most common type of bankruptcy filed in the United States. It provides the fastest path to debt relief and doesn’t require a repayment plan. The person filing bankruptcy typically gets their fresh start in the form of a discharge order within 3 – 4 months of filing their petition.

A bankruptcy trustee reviews the filer’s assets and – assuming the person doesn’t own any non-exempt property – the case is closed.

Since Chapter 7 bankruptcy doesn’t involve a repayment plan, it can’t prevent the foreclosure from happening eventually. The lender can either file a motion for relief from the automatic stay, so they can move forward with the foreclosure proceeding or wait until the bankruptcy discharge is granted.

The only way around that is generally to either bring the mortgage arrears current by paying all missed payments, or by negotiating a loan modification. Filing Chapter 7 bankruptcy may buy you the extra time you need to make this happen, but once the stay is lifted, the lender can simply start the state foreclosure proceeding where it left off.

Some people file Chapter 7 bankruptcy just to get a little extra time to move, but not fight the foreclosure. Assuming it’s their first case, this will buy them at least 3 weeks to get their ducks in a row, possibly more. Since the bankruptcy will cover the mortgage debt, they can move on without having to worry about a deficiency judgment. That’ll be discharged.

A Quick Note About Homeowners’ Associations (HOAs)

If you live in a property that has a homeowners’ association, make sure you stay on top of any HOA assessments that come due after your bankruptcy case is filed. Those are considered post-petition debts and won’t be eliminated by the bankruptcy court’s discharge order.

Preventing a Foreclosure With Chapter 13 Bankruptcy

Chapter 13 bankruptcy is the second most common type of personal bankruptcy. Unlike Chapter 7, it includes a 3 – 5 year payment plan. And, you can use the Chapter 13 bankruptcy process to catch up your arrearage.

You’ll also have to start making the current mortgage payments. But, you’ll have up to 5 years to do this. You can also use Chapter 13 to lower the interest rate on your car loans, if needed. When done, your unsecured debt (like credit cards and medical bills) will be eliminated and your past due payments a thing of the past!

Some bankruptcy courts even offer Mortgage Modification Mediation Programs as part of a Chapter 13 case.

These programs are designed to streamline the mortgage modification process. It connects lenders with their borrowers and gets around the nightmare of having to submit and resubmit seemingly hundreds of documents by using a specifically designed portal. And the bankruptcy court monitors all of it.

Filing Chapter 13 Bankruptcy To Deal With Real Estate Loans

As you can imagine, the bankruptcy process for a Chapter 13 is quite a bit more involved than for a Chapter 7 bankruptcy. If you’re planning on filing Chapter 13 to catch up or modify a real estate loan, it’s best to have a bankruptcy attorney by your side. It’ll be money well spent, especially if you have a second mortgage.

Chapter 13 and Your Second Mortgage

You can use the Chapter 13 bankruptcy process for more than catching up on your first mortgage. If you have a second mortgage (or even a third mortgage) and your home is worth less than what you owe on the first mortgage, you can remove (or “strip”) the junior mortgage(s). That will turn them into an unsecured debt that’s eliminated by the discharge after you make your last monthly payment.

Let’s Summarize…

If you’re behind on your mortgage, you’re not alone. Especially once the coronavirus related forbearance period ends, you’ll be one of thousands facing a possible foreclosure. Filing Chapter 7 Bankruptcy can stop a scheduled foreclosure and buy you a little time to move out. If you’re hoping to save your home you can use Chapter 13 bankruptcy to catch up on the missed mortgage payments.

There are a number of different ways that you can prevent foreclosure, even if you ultimately need to give up your home. Don’t be afraid to explore different options to figure out what’s the right option for your family and personal financial situation.

Equity or Short Sale

Equity Sales

An Equity Sale is a normal real estate listing and transaction when you have sufficient equity in your home. You list your home with a Realtor and pay normal closing costs including real estate commissions from your equity.

If you are behind in payments, have received a Notice of Default (NOD) or Notice of Trustee Sale (NOTS), the lender will normally suspend the process while you sell the property and pay off the loan balance and preserve your equity and credit.

Short Sales

Say you’re selling your home; however, the offer you get is so low, it won’t cover the total amount you owe your lender on your mortgage balance. But you need to unload it, so you’ll take it. This is a short sale—simply put, you end up “short” on paying back your lender, and your lender agrees to accept less than what’s owed on the loan.

Short sales aren’t the norm, but they aren’t all that uncommon, either. According to recent data from real estate information company RealtyTrac, about 5% of all single-family home and condo sales are short sales.

Often homeowners are pushed into a short sale by personal financial troubles that make it impossible to pay their monthly mortgage to their lender. At the same time, they find it hard to sell at a price that would enable them to pay off their entire loan—especially if local real estate market trends have driven down their home’s market value.

This happened in many communities across the nation when real estate market values fell during the housing bust of 2011.

Foreclosure vs. Short Sale: What’s the difference?

While selling a home as a short sale is hardly ideal, many experts argue it’s smarter than pursuing more drastic measures like foreclosure. Foreclosure is when a homeowner falls so behind on the mortgage payments, the lender repossesses the house, often against the homeowner’s will, then tries to sell it. If the amount the mortgage company receives from the sale is less than the mortgage debt owed, depending on state laws, the homeowner may have a deficiency judgment. In other words, the now-former homeowner may still owe money on the home loan.

Foreclosures are less common than short sales. Even during economic downturns like the housing crisis of 2011, the rates rose up to only 3.6%.People often confuse foreclosures with short sales, and while they share some similarities in that both typically happen to homeowners in distress, the process and consequences are very different. For one, the foreclosureprocess typically happens very quickly, since lenders are eager to recoup the costs incurred by the unpaid mortgage.Foreclosure also negatively affects an individual’s credit score and credit report. As a result, individuals who undergo it typically have to wait at least five years before they can qualify for a new home loan.

Bottom line: Foreclosure is scary for good reason. People facing it will want to approach their lender and discuss their options—one of which might be to do a short sale instead.

How Sellers Benefit from Short Sales

Here are a few of the benefits of a short sale for distressed home sellers, and why they might want to consider it over foreclosure:

A short sale does way less damage to a homeowner’s credit report and credit score than a foreclosure. This means the homeowner will be in better shape to apply for a mortgage and buy a new home down the road.

Homeowners have the dignity of being able to sell their own home. This is no small thing.

A short sale enables homeowners to stay in the home until the sale is completed. A foreclosure forces homeowners to vacate.While a seller typically pays all real estate agent commissions and other closing costs, in a short sale the seller pays nothing; the lender or bank foots the bill.

Compare agents

The Short Sale Process

A short sale process starts off like any other home sale: You contact a real estate agent, list your home (mentioning that it’s a “short sale/subject to lender”), then wait for an offer to come in. But once you accept an offer, things get tricky. You’ll need to get the blessing of your lender—and since lenders lose money with short sales, they’re rarely eager to hop on board.

“Some banks may even prefer to pursue a foreclosure, since they not only assume ownership of the property but may receive bailout money from the homeowner’s mortgage insurance policy.”

On the other hand, a short sale may appeal to a lender, since owning and selling real estate are hassles lenders may prefer to avoid.

To assess whether to approve your short sale, your lender will require you to submit some paperwork, including your offer letter as well as a “hardship letter” explaining why you can no longer make your mortgage payments, along with financial documents such as income statements or medical bills to back that up. At that point, the lender will most likely have your home appraised to determine if the offer you’ve received is fair. If it is, the lender may allow the deal to go through, although it may have some stipulations.

How Buyers Benefit from Short Sales

Short sales can be bargains for home buyers, but prepare to jump through many more short-sale-buying hoops than you’d find in a foreclosure or even a typical home sale.

“I wouldn’t recommend short sales for first-time buyers, who may get frustrated with the extra paperwork and long waits,” says Waterhouse. “A traditional sale takes 30 to 45 days to close after the offer is accepted. A short sale typically takes 90 to 120 days, or even longer.”

The reason for these holdups is that the mortgage lenders—which are stuck paying for closing costs that a seller would typically cover—will often counter with their own demands in an effort to raise their bottom line. So, short-sale buyers might hear, “We’ll accept your offer, but you’re responsible for all repairs, wire transfers, and notary fees.”Our advice: Go ahead and negotiate, or walk away if you aren’t satisfied with the terms of the deal. Ultimately it’s up to you to decide whether it’s worth it to absorb these extra costs. When in doubt, ask your real estate agent to help you crunch the short-sale-buying numbers.

Should Buyers Buy Foreclosures instead?

While foreclosures can also be bargains, buyers should know that they come with a lot more risk than a short sale. For one, keep in mind that a foreclosure home is sold at a courthouse, sight unseen. So, there’s no time for a buyer to inspect the house for structural problems; you also inherit all liens tied to a foreclosure. In this sense, a short sale might be a safer transaction.

Deed In Lieu

What Is a Deed in Lieu of Foreclosure?

A deed in lieu of foreclosure is a document that transfers the title of a property from the property owner to their lender in exchange for relief from the mortgage debt.

Choosing a deed in lieu of foreclosure can be less damaging financially than going through a full foreclosure proceeding.

A deed in lieu of foreclosure is an option taken by a mortgagor—often a homeowner—usually as a means of avoiding foreclosure. It is a step that’s usually taken only as a last resort, when the property owner has exhausted all other options, such as a loan modification or a short sale. There are benefits for both parties, including the opportunity to avoid time-consuming and costly foreclosure proceedings.

Understanding Deed in Lieu of Foreclosure

A deed in lieu of foreclosure is a potential option taken by a mortgagor, or homeowner, usually as a means of avoiding foreclosure.

In this process, the mortgagor deeds the collateral property, which is typically the home, back to the lender serving as the mortgagee in exchange for the release of all obligations under the mortgage. Both sides must enter into the agreement voluntarily and in good faith. The document is signed by the homeowner, notarized by a notary public, and recorded in public records.

This is a drastic step, usually taken only as a last resort when the property owner has exhausted all other options (such as a loan modification or a short sale) and has accepted the fact that they will lose their home.

Although the homeowner will have to relinquish their property and relocate, they will be relieved of the burden of the loan. This process is usually done with less public visibility than a foreclosure, so it may allow the property owner to minimize their embarrassment and keep their situation more private.

If you live in a state where you are responsible for any loan deficiency—the difference between the property’s value and the amount you still owe on the mortgage—ask your lender to waive the deficiency and get it in writing.

Deed in Lieu vs. Foreclosure

Deed in lieu and foreclosure sound similar but are not identical. In a foreclosure, the lender takes back the property after the homeowner fails to make payments. Foreclosure laws can vary from state to state, and there are two ways foreclosure can take place:

Judicial foreclosure, in which the lender files a lawsuit to reclaim the property.

Nonjudicial foreclosure, in which the lender can foreclose without going through the court system.

The biggest differences between a deed in lieu and a foreclosure involve credit score impacts and your financial responsibility after the property has been reclaimed by the lender. In terms of credit reporting and credit scores, having a foreclosure on your credit history can be more damaging than a deed in lieu of foreclosure. Foreclosures and other negative information can stay on your credit reports for up to seven years.

When you release the deed on a home back to the lender through a deed in lieu, the lender generally releases you from all further financial obligations. That means you don’t have to make any more mortgage payments or pay off the remaining loan balance. With a foreclosure, the lender could take additional steps to recover money that you still owe toward the home or legal fees.

If you still owe a deficiency balance after foreclosure, the lender can file a separate lawsuit to collect this money, potentially opening you up to wage and/or bank account garnishments.

Advantages and Disadvantages of a Deed in Lieu of Foreclosure

A deed in lieu of foreclosure has advantages for both a borrower and a lender. For both parties, the most attractive benefit is usually the avoidance of long, time-consuming, and costly foreclosure proceedings.

In addition, the borrower can often avoid some public notoriety, depending on how this process is handled in their area. Because both sides reach a mutually agreeable understanding that includes specific terms as to when and how the property owner will vacate the property, the borrower also avoids the possibility of having officials show up at the door to evict them, which can happen with a foreclosure.

In some cases, the property owner may even be able to reach an agreement with the lender that allows them to lease the property back from the lender for a certain period of time. The lender often saves money by avoiding the expenses they would incur in a situation involving extended foreclosure proceedings.

In evaluating the potential benefits of agreeing to this arrangement, the lender needs to assess certain risks that may accompany this type of transaction. These potential risks include, among other things, the possibility that the property is not worth more than the remaining balance on the mortgage and that junior creditors might hold liens on the property.

The big downside with a deed in lieu of foreclosure is that will damage your credit. This means higher borrowing costs and more difficulty getting another mortgage in the future. You can dispute a foreclosure on your credit report with the credit bureaus, but this doesn’t guarantee that it will be removed.

Deed in Lieu of Foreclosure

Pros

Reduces or eliminates mortgage debt without a foreclosure

Lenders may lease back the property to the owners.

Often preferred by lenders

Cons

Hurts your credit score

More difficult to obtain another mortgage in the future

The house can still remain underwater.

Reasons Lenders Accept or Reject a Deed in Lieu of Foreclosure Agreement

Whether a lender decides to accept a deed in lieu or reject can depend on several things, including:

How delinquent you are on payments

What’s owed on the mortgage

The property’s estimated value

Overall market conditions

A lender may agree to a deed in lieu if there’s a strong likelihood that they’ll be able to sell the home relatively quickly for a decent profit. Even if the lender has to invest a little money to get the home ready for sale, that could be outweighed by what they’re able to sell it for in a hot market.

A deed in lieu may also be attractive to a lender that doesn’t want to waste time or money on the legalities of a foreclosure proceeding. If you and the lender can come to an agreement, that could save the lender money on court fees and other costs.

On the other hand, it’s possible that a lender might reject a deed in lieu of foreclosure if taking the home back isn’t in their best interests. For example, if there are existing liens on the property for unpaid taxes or other debts or the home requires extensive repairs, the lender might see little return on investment by taking the property back. Likewise, a lender may be put off by a home that’s drastically declined in value relative to what’s owed on the mortgage.

If you think a deed in lieu of foreclosure may be in the cards for you, keeping the home in the best condition possible could improve your chances of getting the lender’s approval.

Does a Deed in Lieu of Foreclosure Hurt Your Credit?

Yes, a deed in lieu of foreclosure will negatively impact your credit score and remain on your credit report for four years. According to experts, your credit can expect to take a 50 to 125 point hit by doing so (which is less than the 150 to 240 points or more resulting from a foreclosure).

Which Is Better: Foreclosure or Deed in Lieu?

Most often a deed in lieu of foreclosure is preferred to foreclosure itself. This is because a deed in lieu allows you to avoid the foreclosure process and may even allow you to remain in the house. While both processes damage your credit, foreclosure lasts 7 years on your credit report but deed in lieu just 4 years.

When Might a Lender Reject an Offer of a Deed in Lieu of Foreclosure? While often preferred by lenders, they may reject an offer of a deed in lieu of foreclosure for several reasons. The property’s value may have continued to drop or if the property has a large amount of damage, making the deal unattractive to the lender. There may also be outstanding liens on the property that the bank would have to assume, which they prefer to avoid. In some cases your original mortgage note may forbid a deed in lieu of foreclosure altogether.

The Bottom Line

A deed in lieu of foreclosure could be a suitable remedy if you’re struggling to make mortgage payments. Before committing to a deed in lieu of foreclosure, it’s important to understand how it may impact your credit and your ability to buy another home down the line. Considering other options, including loan modifications, short sales, or even mortgage refinancing, can help you choose the best way to proceed.

Rent the Property

A homeowner who has mortgage payment low enough that market rent will allow it to be paid, can convert their property to a rental and use the rental income to pay the mortgage.

Service Members Civil Relief Act (SCRA)

If a member of the military is experiencing financial distress due to deployment, and that person can show that their debt was entered into prior to deployment, they may qualify for relief under the Service members Civil Relief Act. The American Bar Association has a network of attorneys that will work with service members in relation to qualifying for this relief.

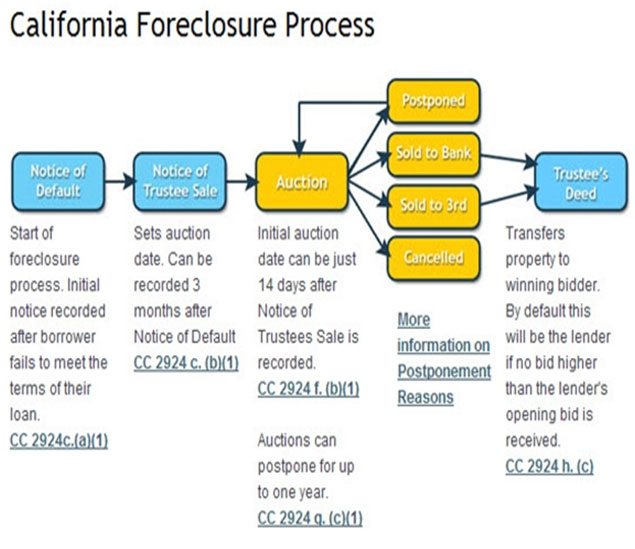

CALIFORNIA NOTICE OF DEFAULT (NOD)

NOTICE OF TRUSTEE SALE (NOTS)

THE BEGINNING OF THE CALIFORNIA FORECLOSURE PROCESS

CALIFORNIA FORECLOSURE TIMELINE STARTS WITH NOTICE OF DEFAULT

WHAT IS A NOTICE OF DEFAULT? WHEN DO THE BANKS SEND

THEM? WHAT DO THEY MEAN? WHO CAN HELP ME?

The Notice of Default, filed with the County Recorder’s office, is the beginning of non-judicial foreclosure process in California:Once the Notice of Default is recorded, the foreclosure time frame begins. This is technically the foreclosure starting point, and the beginning of the legal length of time to foreclose in California.

California foreclosure law says that within 10 business days after recording, a copy of the recorded Notice of Default is sent by certified and regular mail to the borrowers at any addresses provided and any recorded special requests.

After no more than 30 days, a copy of the Notice of Default is sent by certified and regular mail to new owners and all junior lien holders to the Deed of Trust being foreclosed. A Trustee’s Sale Guarantee Report is ordered from the title company providing all title information. The foreclosure sale, or Trustee’s Sale can be formally scheduled 90 days after the NOD is filed. And the Foreclosure Sale Date can typically be no shorter than 21 days, (with some variances).

The California Civil Code that spells out the California foreclosure laws, foreclosure process of the

Notice Of Default is Section 2429c.

CALIFORNIA FORECLOSURE TIMELINE

Day 1, Missed Payment

The first step along the California foreclosure timeline is a missed payment. Maybe you lost your job, suffered a serious illness, or just fell behind. Oftentimes, when you miss the first payment, or even the first few, there is a grace period in which your bank will send you a reminder and assess a late fee before any further proceedings kick off. For purposes of this timeline, we are looking at the shortest possible process.You may be able to make it up the next month, but it can be tough with the late fees and interest. It’s easy to fall even further behind, which puts your home at risk. The exact point at which your loan is considered “in default” depends on the terms of your specific loan.

For most mortgages, it happens when you’re 90 days late.

Day 120, Notice of Default

When your home loan is officially in default, the bank must file a Notice of Default with the court. They have to let you know they’ve filed it within 10 days. It’s an official legal document informing you that you are in a state of default on your loan. It will include information about your options for getting out of default. For example, you can pay all the back payments, along with interest and fees, to get out of default. You’ll also need to keep up your insurance and property taxes.

Due to federal mortgage servicing laws, defined by the Consumer Finance Protection Bureau, your servicer must wait 120 days before making a first official notice, or before they file a judicial or non-judicial foreclosure (described below).

If you don’t have the cash to pay all that at once, the home will continue to be in default.

Day 180, Notice of Trustee Sale

After you’ve received a Notice of Default, you have 3 months in which to attempt to get your loan current. As mentioned above, that means paying all back payments, interest, fees, property taxes, and insurance. After 3 months, the bank can officially set a date for the auction of your home. You will be notified that this has happened through a Notice of Trustee Sale that is typically sent to you via certified mail.

Day 200, Auction

After you’ve received a Notice of Trustee Sale, the bank can set a date for the auction. It has to wait at least 20 days after the Notice of Trustee Sale is sent to you. The sale may be postponed by a court or by the bank for up to a year, after which point they’ll need to send you a new Notice of Trustee Sale in order to send the house to auction. At the auction, your home will be sold to the highest bidder.

Nonjudicial Foreclosures in California

The vast majority of California foreclosures are nonjudicial, meaning the bank does not have to go through a court to foreclose. If your home is sold in a nonjudicial foreclosure, your responsibility ends once the home is sold. You may have to pay fees relating to the sale, but you won’t owe any more money on your mortgage even if the home sells for less than you owe. You may, however, still owe a second mortgage (if you have one) that was not used to purchase the house (for example, a home equity line of credit).

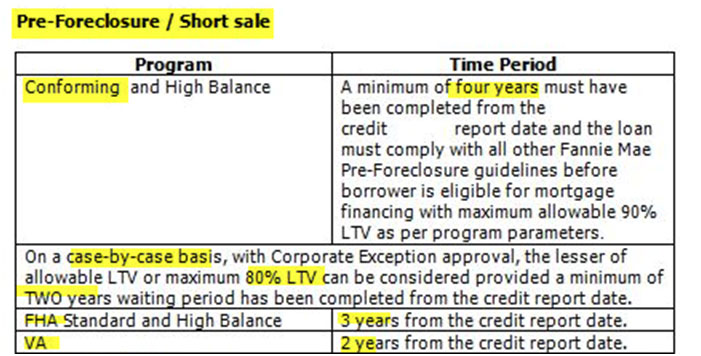

TIMELINES FOR PURCHASING AFTER SHORT SALE, FORECLOSURE, BANKRUPTCY AND DEED IN LIEU

Conventional : It is 4 years for Conventional financing, some lenders may allow a 2- year period with compensating variables (for example if they never had a late payment before they short sold).

FHA: 3 years

VA: 2 years

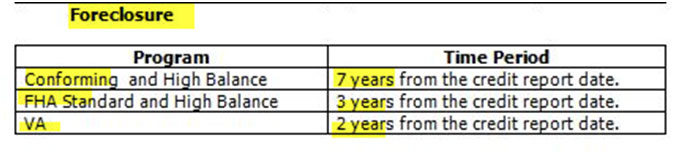

Conventional: 7 years

FHA: 3 years

VA: 2 years

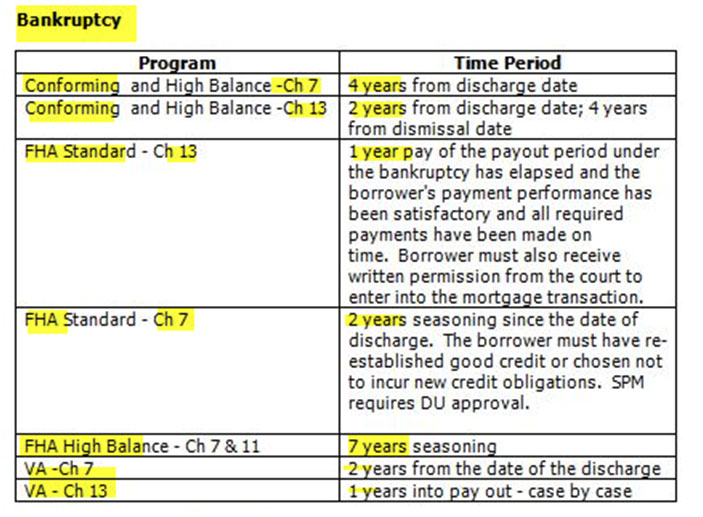

Here are the time lines for when a buyer can purchase again after suffering a Bankruptcy and they are trying to obtain either Conventional, FHA or VA financing.

Conventional: For a chapter 7 Bankruptcy it is 4 years and 2 years for a chapter 13 bankruptcy for Conventional financing.

FHA: For a chapter 7 Bankruptcy it is 2 years and 1 year fora chapter 13 for FHA financing.

VA: For a chapter 7 Bankruptcy it is 2 years, and 1 year for a chapter 13 bankruptcy for VA financing.

Deed In Lieu

Conventional: 4 years

FHA: 3 years

VA: 2 years

Note: Not finalized when sign paperwork and turn in keys. Title remains in name of homeowner for months, if not years, until deed has changed and lender’s Name is on Deed and recorded.

BUYING DISTRESSED PROPERTIES

At times, many of the homes for sale fall under the category of “distressed properties. These are homes that have either gone through foreclosure or are being marketed as “short sales.” In a short sale, the homeowner can’t afford to maintain the mortgage but the lender – rather than foreclosing – agrees to the sale of the property for less than the balance of the loan.

These types of sales have different dynamics than traditional sales with more paperwork, often a longer transaction process and, in some cases, more frustration. For these reasons, many buyers shy away from foreclosures or short sales.

However, if you understand the potential pitfalls of purchasing a distressed property – and work with an agent who has a thorough knowledge of this market – you can get a great home at a reduced price. Is a distressed property for you? Here are the pros and cons of buying one.

Advantages of Buying a Distressed Property

First, you’ll be dealing with a highly motivated seller – either a bank in the case of a foreclosure, or in a short sale, sellers who are in financial trouble and very interested in getting out of a mortgage they can no longer afford.

These types of sales take much of the emotion out of the process. You won’t be insulting anybody, for instance, if you make an offer that’s lower than the asking price. (That’s not to say that the low offer will necessarily be accepted, of course.)

Lenders are extremely interested in getting these homes sold and off the liability side of their balance sheets. Many foreclosed properties can be purchased at a lower price of what they would have commanded several years earlier.

If you’re looking at a short sale, you’re not likely to get quite as good a deal as on a foreclosure. But there are definite advantages to purchasing one of these homes. For one thing, since the home owners want to get the home sold quickly, they are likely to keep it well-maintained and in good move-in condition.

Disadvantages of Purchasing a Distressed Property

If you’re looking for a “steal,” you’re probably not going to find it. If you’re purchasing a home to live in, you’ll often be competing not only against buyers similar to yourself, but against investors. More competition inevitably leads to higher prices.

The transaction process for short sales or foreclosures often takes longer than traditional transactions. It’s sometimes not clear which lending institution actually owns a mortgage loan, and it can take time to get it all sorted out – especially if there’s a second or even third mortgage involved, which is often the case.

Some foreclosed properties are also in rough condition. Many have sat idle for a long time with minimal or no maintenance. The departing owners may have sold off fixtures, or damaged the property.

Purchasing Tips

It’s critical to have the home professionally inspected before you make an offer or put down earnest money. The inspector will assess the structure’s soundness and may uncover problems that would be very costly to repair. Banks usually sell foreclosed homes as-is, meaning they won’t make any allowances for repair. And even in a short sale, they likely won’t make any such allowances, because they’re already losing money on the transaction.

You should have your financing in order before pursuing a foreclosure purchase. Pre-approved buyers have the best chance of getting the property in case of multiple offers. Also, banks generally aren’t interested in contingencies (for instance, needing to sell your current home before purchasing another).

Distressed Properties and FHA Loans

If you’re a first-time buyer, a federally insured FHA (Federal Housing Administration) loan might be a good option. The FHA has a program to help you repair a fixer-upper. You can get one loan that combines the mortgage with the repair costs. The amount of the loan is based on the projected value of the property once repairs are made.

FHA loans only require 3.5 percent down payment – compared to typically 20% with conventional loans – and the down payment can come from an employer, family member or charitable organization. FHA loans also have lower closing costs than conventional mortgages.

Since the federal government insures these loans, you’ll get a competitive interest rate and lenders may be willing to give you terms that make it easier to qualify for a loan.

If you have less-than-perfect credit, it’s easier to obtain an FHA loan than a conventional loan.

About HUD Homes

FHA-insured homes that go into foreclosure are acquired by the U.S Department of Housing and Urban Development (HUD). HUD homes are offered for sale through internet sites managed by management companies under contract to HUD.

Real estate agents who register with HUD can submit offers on behalf of their clients. HUD pays the agent’s commission.

HUD homes are sold as-is, without any warranty. HUD doesn’t make repairs nor pay to correct any problems. Again, that makes it critical to have homes inspected before making an offer.

In designated revitalization areas, law enforcement officers, K-12 teachers, firefighters and emergency medical technicians can purchase a home at 50% off the listing price. (They must commit to live in the property for three years.)

Contact our Team by Email at

Info@SummitRealEstateGroup.net or call at…

Orange County: 949.305.0121 (tel: +1.949.305.0121)

Los Angeles County: 661.510.3042 (tel: +1.661.510.3042)